While Customer Service may be undergoing a makeover in light of recent protests, Target and Walmart are staying closed for Christmas this year. Dick’s Sporting Goods is also closing for Thanksgiving.

2020 is a year unlike any other with more rapid changes to business and the world as we know it.

The biggest shopping events of the year will take on a new tone now, as crowds are prohibited from gathering due to the rapid spread of the Corona Virus with over 16 million new cases globally.

Giant retailers are encouraging consumers to shop earlier online for the holidays and promise to start sales earlier as well, according to Target's blog.

Context is everything right now, this 2019 seemingly normal picture of what life was like shopping pre-C19 now, will trigger many emotionally, seeing people without masks at the checkout:

The year is flying by at super sonic speeds despite the feeling that time is dragging by extra slow, stuck at home and feeling cabin feverish.

The speed of major events that keep happening is making it hard to feel like we have had enough time to savor the moments, as each day can bring new challenges when adapting to life on lockdown.

This coming Monday U.S. Senate Republicans are expected to reveal a new $1 trillion coronavirus aid package. This could add more economic stimulus and perhaps even indicate a bull market trend for big oil who has been suffering losses due to reduced travel during the pandemic.

Per Reuters:

Brent crude LCOc1 lost 81 cents, or 1.9%, to $42.53 a barrel by 11:13 a.m. EDT, while U.S. West Texas Intermediate (WTI) crude CLc1 fell 65 cents, or 1.6%, to $40.64 a barrel.

Following the closures of consulates in Houston and Chendu, investors worried about relations between China and the United States and have retreated to safe havens, such as gold and bonds.

Is big oil partially responsible for Americans getting stimulus checks?

This is a good question, as the oil industry hasn't shirked donating millions to politicians in exchange for political favors in the past. This is part of what killed the electric car before Elon Musk brought it back through better brand definition and audience targeting.

Credit: Zbynek Burival

The more money consumers have, the more likely they'll use that money to break the monotony of staying at home all the time and splurge on trips, drive more and oil companies benefit from this.

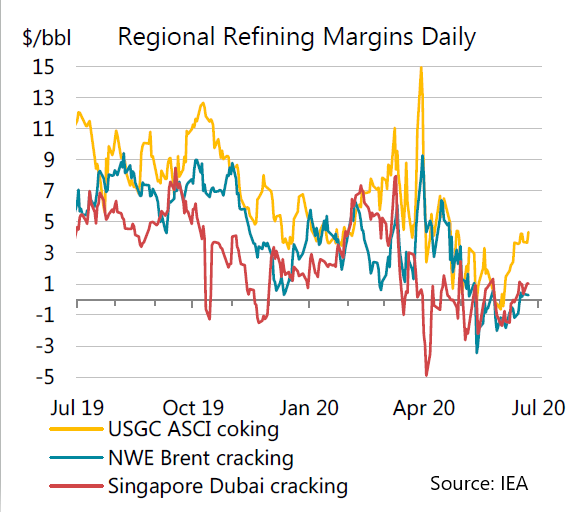

The oil industry is doing everything they can to find a way to survive right now as the margins for refined oil products have dropped into negative areas:

Source: IEA

To be fair, trading divisions can make money even when prices dip by exploiting choppy market moves.

Is it possible that these fossil fuel companies, out of self interest, are pulling the strings they have to pull to nudge politicians towards printing more Monopoly money out?

When the Terminator can become the governor of California and someone who is illiterate, unable to read at all can become president in 2016 - who is to say what's possible these days...

There is still the larger question of where we go from here, for a long term plan. There are greater things at stake micro and macro level.

I haven't been able to see my son for a long time, since Christmas in 2019 as the pandemic hit and the fear that either one of us is asymptomatic keeps his mother from allowing visitation. Will I ever see him again?

Many families are experiencing strife due to how things are panning out, unable to go back to work because daycares aren't open and schools are closed to only virtual classes.

Oil based capitalism is literally the backbone of much of America's economy. When the bottom drops out as the flow of petrodollars halts there are new problems: where do we put all this oil?

Three quarters of the world's storage capacity have already been reached and the limits were tapped back in May 2020 this year as The Petroleum Economist reports.

Another side effect is that Exxon, Shell, BP, and a handful of others — who are much better positioned to survive this crisis than smaller producers — are using the crisis to try to roll back environmental regulations.

So perhaps not quite the benevolent saviors their PR agents would have us believe they are. While it's easy to say things like, just go green with wind, solar and hydroelectric energy sources this ignores how entrenched oil as a commodity is in the stability of existing markets for the global economy.

One of the newest coping mechanisms of fossil fuelers is Russia may agree to a three-way arrangement with Saudi Arabia and the U.S. to limit output to halt the downward slide of oil product prices.

Previously, Putin was resisting any concessions in a stand-off with Saudi Arabia since Moscow pulled out of a supply-limit agreement with OPEC over demands for deeper cuts in output.

But the reality is this industry has to prepare for challenging times, low oil prices, and learn how to adapt like the rest of us to the rapidly evolving situation with the corona virus.

There is no doubt that political alignments are being reworked, and arrangements are being made to consolidate in the interests of the most powerful forces at work in the world.

I'd like to see the same desperate winner take all driving unstoppable force the fossil fuel industry has right now, also coming from renewable energy providers.

In the aftermath of the pandemic, there will be new winners and losers. I would like to see a more sustainable business model from green energy that creates new markets for both investors and consumers.

What changes would you like to see after C19? Comment below!

. . .

Enjoyed this blog?

Signup here to get updates on new startup blogs.

Is Facebook not explaining why the disapproved an ad?

I worked at FB for years and offer FB Policy Consulting here

Available for freelance writing and guest posting on your blog: [email protected]

Hi there mates, nice post and pleasant arguments commented at this place, I am really enjoying by these.|

Thanks for reading!

For sure